The employer has an Earned Sick Leave policy in compliance with the law and a separate paid time off PTO policy. Contribution Rate 493KB Wage Ceiling 1168KB Rate of Interest 3648KB Process for Change in Name.

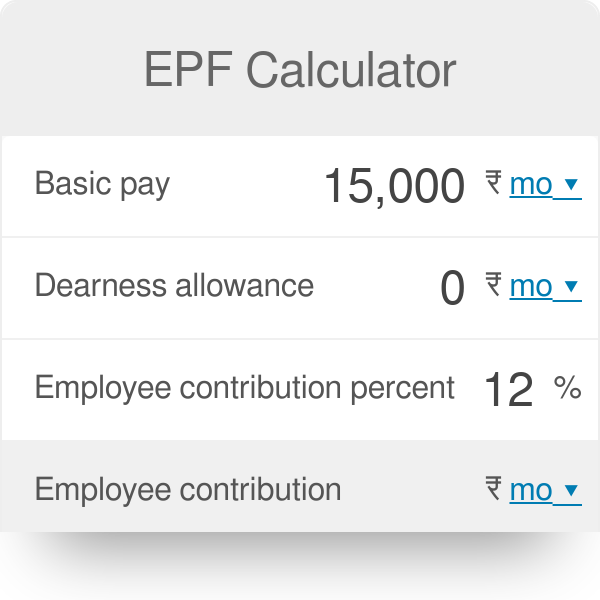

Epf Calculator Employees Provident Fund

The applicable interest rate on EPF contribution for the financial year 2021-22 is 810.

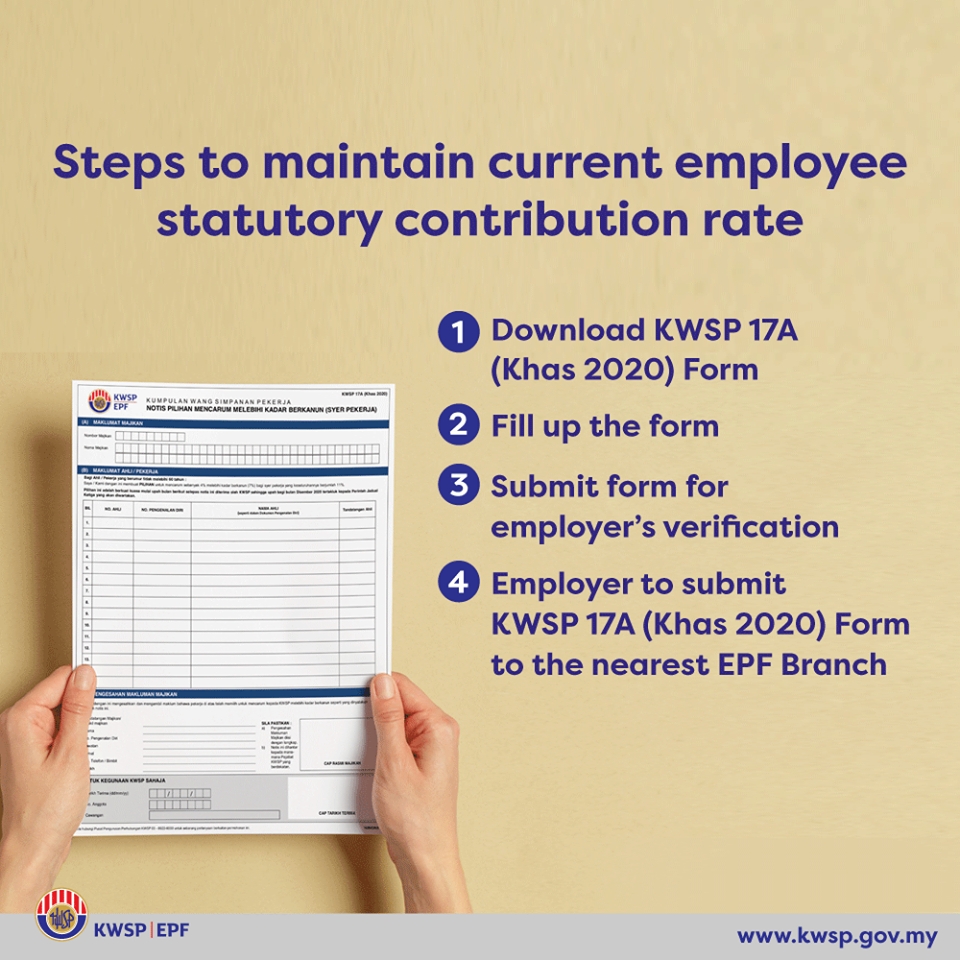

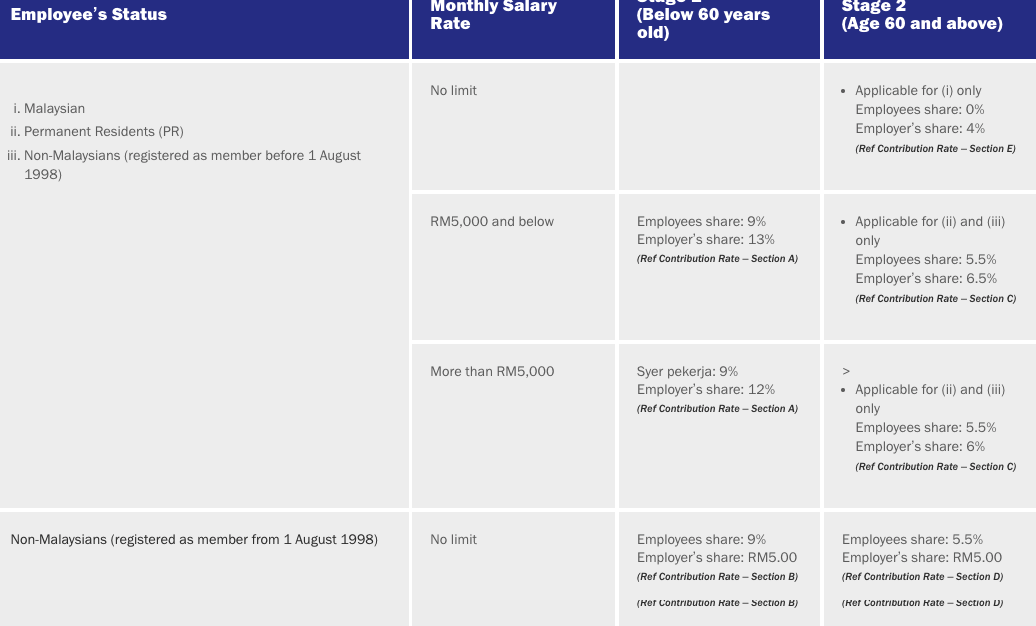

. This will be available to the new female employees for the first 3 years of employment. Employees EPF contribution rate for all employees under 60 years old is reduced from 11 to 9 by default from February 2021 contribution to January 2022 contribution. The employer makes the contribution to these schemes on behalf of the employees.

For EPF 367. 6 Ref Contribution Rate Section C Non-Malaysians registered as member from 1 August 1998 No limit. The full break-up of the percentage of contribution is as seen below.

In Many Companies Employee and Employer are Paying PF on higher amount of 20000 Employee Contribution EPF12 200002400 Employer Contribution EPS833150001250 Difference2400-12501150 Total Employer PF125011502400 Note- Even if PF is calculated at higher amount For EPS we will take 15000 limit only. EPF contribution rate for the newly recruited female employees has been reduced from 12 to 8. Normally we see that the contribution from the employer can not be seen in the payslip but can only be seen your offer letter.

EPFO - Mobile Application UMANG UAN Presentation 639KB Resolution on Service Delivery Ethics 1298KB EPS 1995 - List of Pension Disbursing Banks 2193KB. In case of establishments which employ less than 20 employees or meet certain other conditions as notified by the EPFO the contribution rate for both employee and the employer. The employee can pay at a higher rate and in such case employer is not under any obligation to pay at such higher rate.

Vide notification dated 22082014 Ministry of Labour and Employment has increased Employee Provident Fund EPF Limit to Rs. Under the Employees Provident Funds and Miscellaneous Provision Act 1952 an employee makes a mandatory contribution at the rate of 12 to their EPF account and the employer will have to match this contribution. Current EPF Interest rate is 865.

Contribution paid by the employer is 12 per cent of basic wages plus dearness allowance plus retaining allowance. Employers may deduct the employees share from their salary. 15000 from existing Rs.

In such case employer has to pay administrative charges on the higher wages wages above 15000-. Employees EPF Contribution as a of Salary Generally 12. Contribution by the Employee and Employer to the EPS EPF and EDLI.

The minimum amount of contribution to be made by the employer is set at a rate of 12 of Rs. Employees EPF contribution rate. The total contribution by the employer and employee towards the EPF account of the employee Rs 1680 Rs 514 Rs 2194.

Effective from April 2020 salarywage up to December 2020 May 2020 contribution month up to January 2021. Current interest rate. Once you provide these inputs the EPF Calculator does all the hard work for you and tell you How much EPF Corpus is accumulated by Retirement.

Total EPF contribution every. EPF Contribution Rules. The contribution of Employer is calculated as.

How to check if your taxable salary includes employers contribution to pension account. The employee contribution is deducted from the salary before they credit the salary. However this 12 is further.

An employer must register on EPFO if there are 20 or more employees. August 4 2022 5. Under the Employees Provident Fund EPF rules 12 of the salary basic dearness allowance of the employee has to be contributed to the provident fund account.

For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and. EPF interest rate retained at 850 for FY 2020-21 Announced on March 4th 2021. The monthly wages of Malaysians aged 60 and over and non-Malaysians of any age do not affect the employers EPF contribution rate.

To pay contribution on higher wages a joint request from Employee and employer is required Para 266 of EPF Scheme. And a break up of your salary will show Employer contribution to NPS or some such. Contribution by an employer -The contribution made by the employer is 12 of the basic salary of the employee.

Check your Form 16 See our GUIDE to understand form 16 here Your Form 16 will look like this. The breakup of EPF contribution is different for the employee and the employer. Assuming the employee joined the Firm XYZ in April 2019.

An employer is also allowed to make contributions into an employees NPS account and this is entirely voluntary. An equal contribution is payable by the employee also. Employer 367 into EPF.

Therefore 12 of the basic salary is contributed by the employer and the other 12 is contributed by the employee. Employers may deduct the employees share from their salary. Look for a break up of total taxable salary.

The interest rate is 81 for FY 2022-23. 6 Ref Contribution Rate Section C Non-Malaysians registered as member from 1 August 1998 No limit. Employers EPF contribution rate.

Employees Provident Fund Interest Rate Calculation 2022. According to a Bengaluru bench of the Income-Tax Appellate Tribunal ITAT ruling the interest credited to an Employees Provident Fund EPF account after an individual ceases to be in employment is taxable in his hands in the year of. Employers EPF Contribution as a of Salary Generally 367.

In addition to 12 of employer PFPS contribution the employer also has to pay other charges. Employers Contribution towards EPF. This amount equals Rs.

EPF Interest Rate. If the old employer has already assigned the UAN the employee should provide such details to the new employer. However for employees joining the service for the first time the eacmployer needs to generate the UAN for the employee.

On January 1 of each year the taxable wage cap. However do note that if the. Written by Rajeev Kumar Updated.

The contribution rate for employers varies from 010 to 075. To get more details to Calculate your Interest Rate of your EPF or PF at Growwin. 15000 although they can voluntarily contribute more.

So the interest rate applicable for each month is. The employer needs to pay both the employees and the employers share to the EPF. The total EPF contribution for April will be Rs 2194.

However during the period when contributions dont get credited to the PF account the interest rate earned does not remain tax-free. Employers contribution towards EPF 3600 1250 2350. Employee 12 of Employee Provident Fund EPF.

PART II THE BOARD AND THE INVESTMENT PANEL. The employer needs to pay both the employees and the employers share to the EPF. How to Obtain UAN for EPF.

The contribution that is made as a part of your salary is called EPF and can be seen in the payslip. EPF Interest Rate - Interest rate of EPF is reviewed every year after consultation with the Ministry of Finance by EPFOs Central Board of Trustees. Establishment of the Board.

Epf Employer Contribution Rate Rylandcxt

Basics And Contribution Rate Of Epf Eps Edli Calculation

Epf Contribution Rates 1952 2009 Download Table

Epf A C Interest Calculation Components Example

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Employee Epf Contribution Rate Reduced Form 12 To 10 Workforce Blog

Epfo On Twitter Frequently Asked Questions About Reduction In Statutory Rate Of Epf Contribution From 12 To 10 Indiafightscorona Epfo Stayhomestaysafe Socialsecurity Https T Co Ojavinbtbc Twitter

Updated Epf 7 Contribution Rate Starts In April 2020 Here S How To Keep It At 11 Soyacincau

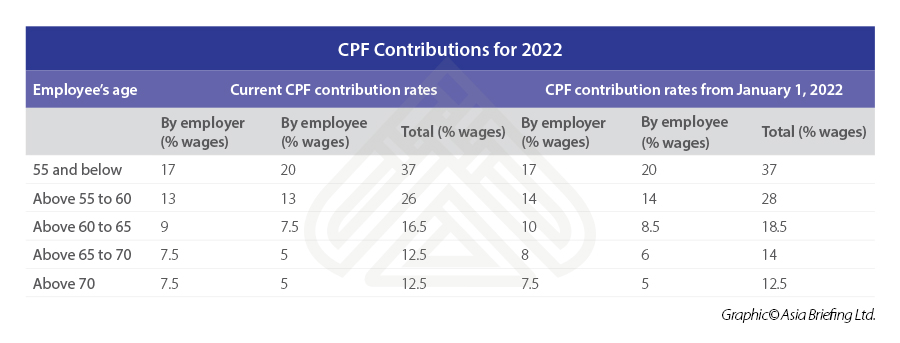

Singapore To Increase Central Provident Fund Contributions From 2022

Employee Provident Fund Epf Changed Rules From 1st Sept 2014 Sap Blogs

What Is The Epf Contribution Rate Table Wisdom Jobs India

Creating Epf Contribution Pay Head Payroll

Time Value Of Money Computing The Retirement Fund In Epf Account Of An Employee Kclau Com

Pf Contribution Rate From Salary Explained

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

Esi And Pf Calculation Based On Pay Grade For India Sap Blogs

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax